Review to Select Medicare Advantage Plans: Save Hundreds on Insurance so you can Start Now

Understanding Medicare Advantage Plans

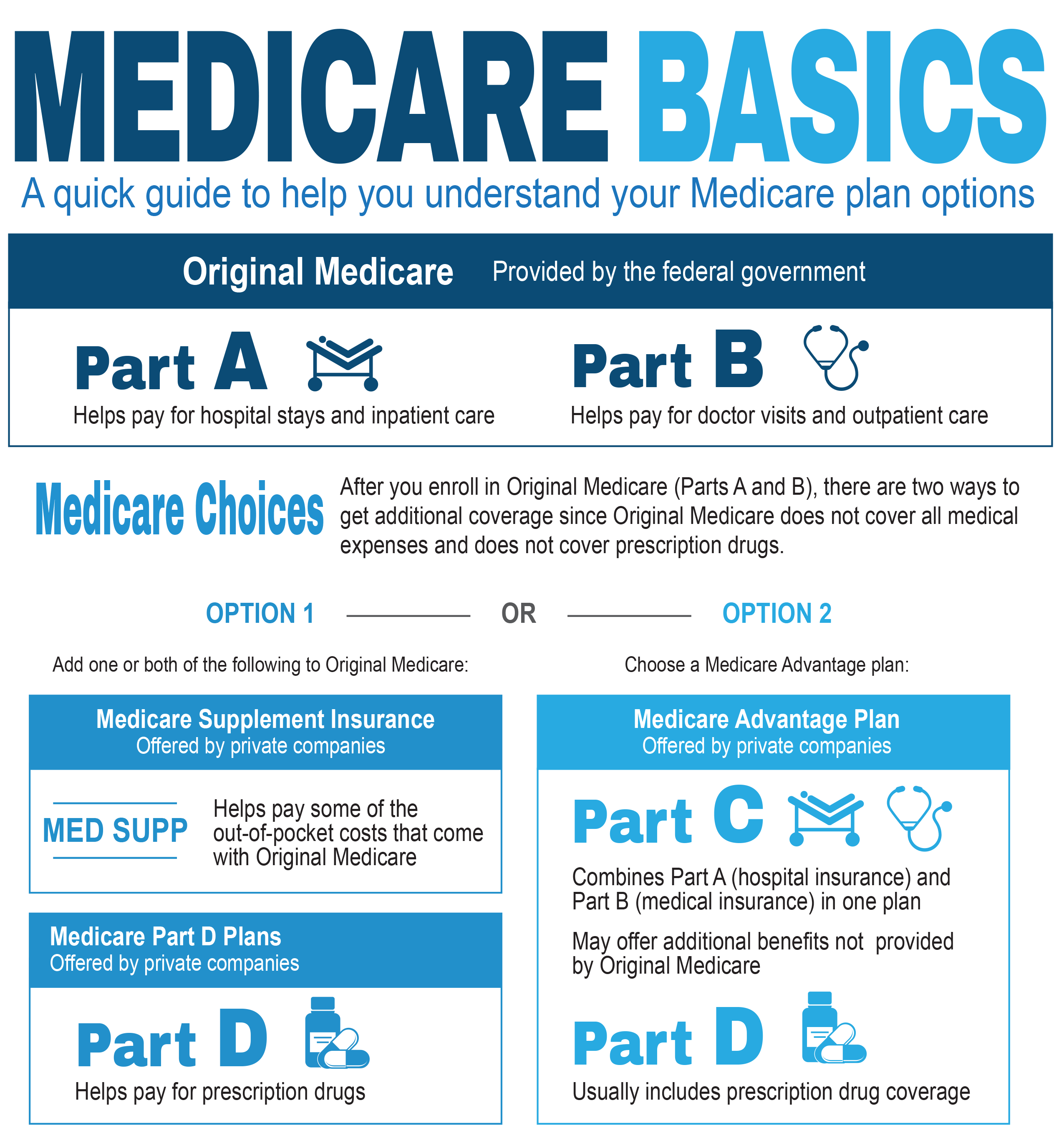

Medicare Advantage Plans are offered by non-government Insurance companies that work alongside Medicare to deliver Part A in addition to Part B benefits in a single integrated model. Unlike traditional Medicare, Medicare Advantage Plans commonly include additional benefits such as prescription coverage, dental care, eye care services, along with wellness programs. Such Medicare Advantage Plans function within established coverage regions, which makes location a critical consideration during comparison.

Ways Medicare Advantage Plans Differ From Original Medicare

Original Medicare provides open medical professional access, while Medicare Advantage Plans generally operate through structured care networks like HMOs and PPOs. Medicare Advantage Plans may include provider referrals alternatively in-network doctors, but they commonly offset those constraints with structured out-of-pocket amounts. For many beneficiaries, Medicare Advantage Plans offer a balance between affordability plus expanded coverage that Traditional Medicare independently does not deliver.

Which individuals Might Consider Medicare Advantage Plans

Medicare Advantage Plans attract beneficiaries interested in organized care and also possible expense reductions under one unified plan structure. Older adults handling chronic conditions commonly choose Medicare Advantage Plans because integrated care models streamline ongoing care. Medicare Advantage Plans can additionally attract enrollees who want combined benefits without managing multiple supplemental plans.

Eligibility Requirements for Medicare Advantage Plans

To be eligible for Medicare Advantage Plans, participation in Medicare Part A plus Part B required. Medicare Advantage Plans are accessible for most people aged 65 in addition to older, as well as under-sixty-five individuals with eligible medical conditions. Participation in Medicare Advantage Plans depends on residence within a PolicyNational Medicare Advantage plan’s service area also timing that matches approved enrollment periods.

When to Sign up for Medicare Advantage Plans

Timing has a vital function when enrolling in Medicare Advantage Plans. The Initial sign-up window surrounds your Medicare eligibility milestone along with enables initial choice of Medicare Advantage Plans. Overlooking this period does not end eligibility, but it often alter available options for Medicare Advantage Plans later in the year.

Yearly along with Qualifying Enrollment Periods

Each fall, the Annual Enrollment Period allows enrollees to change, remove, with add Medicare Advantage Plans. Qualifying enrollment windows open when life events take place, such as moving even coverage termination, enabling changes to Medicare Advantage Plans outside the normal schedule. Recognizing these periods helps ensure Medicare Advantage Plans remain within reach when situations change.

Ways to Compare Medicare Advantage Plans Successfully

Evaluating Medicare Advantage Plans requires attention to more than recurring premiums alone. Medicare Advantage Plans differ by provider networks, out-of-pocket spending limits, prescription formularies, with coverage rules. A careful assessment of Medicare Advantage Plans assists aligning healthcare priorities with coverage structures.

Costs, Benefits, in addition to Provider Networks

Recurring expenses, copayments, also yearly limits all shape the overall value of Medicare Advantage Plans. Certain Medicare Advantage Plans include minimal premiums but elevated out-of-pocket expenses, while others prioritize stable spending. Doctor availability also changes, so making it important to confirm that preferred doctors participate in the Medicare Advantage Plans under review.

Prescription Benefits & Extra Benefits

Many Medicare Advantage Plans include Part D prescription coverage, streamlining medication management. In addition to medications, Medicare Advantage Plans may cover wellness programs, ride services, or over-the-counter allowances. Reviewing these elements ensures Medicare Advantage Plans fit with ongoing medical needs.

Enrolling in Medicare Advantage Plans

Sign-up in Medicare Advantage Plans can take place online, by phone, and/or through authorized Insurance Agents. Medicare Advantage Plans need accurate personal details & confirmation of eligibility before activation. Finalizing enrollment accurately helps avoid delays with unexpected coverage interruptions within Medicare Advantage Plans.

The Value of Authorized Insurance Agents

Licensed Insurance Agents help explain coverage specifics in addition to explain differences among Medicare Advantage Plans. Speaking with an experienced professional can clarify network restrictions, benefit limits, plus costs associated with Medicare Advantage Plans. Expert assistance often simplifies the selection process during enrollment.

Typical Mistakes to Avoid With Medicare Advantage Plans

Overlooking doctor networks details stands among the frequent issues when selecting Medicare Advantage Plans. Another problem involves concentrating only on monthly costs without reviewing annual expenses across Medicare Advantage Plans. Reading plan documents thoroughly reduces confusion after enrollment.

Reviewing Medicare Advantage Plans Each Year

Healthcare requirements evolve, also Medicare Advantage Plans change each year as well. Reviewing Medicare Advantage Plans during annual enrollment allows adjustments when coverage, costs, and doctor access vary. Regular assessment keeps Medicare Advantage Plans matched with present medical goals.

Reasons Medicare Advantage Plans Keep to Expand

Enrollment data demonstrate increasing engagement in Medicare Advantage Plans across the country. Expanded benefits, predictable spending caps, as well as coordinated care help explain the growth of Medicare Advantage Plans. As choices increase, informed evaluation becomes increasingly valuable.

Long-Term Value of Medicare Advantage Plans

For many beneficiaries, Medicare Advantage Plans provide reliability through connected benefits in addition to structured healthcare. Medicare Advantage Plans can lower management complexity while encouraging preventive services. Selecting appropriate Medicare Advantage Plans establishes peace of mind throughout retirement stages.

Evaluate plus Sign up for Medicare Advantage Plans Today

Taking the right move with Medicare Advantage Plans begins by reviewing current options and verifying eligibility. If you are entering Medicare even revisiting current coverage, Medicare Advantage Plans offer flexible solutions built for diverse healthcare needs. Review Medicare Advantage Plans now to find coverage that aligns with both your health plus your financial goals.